Zero emission HGV registrations surged in 2025 even as the wider UK truck market contracted by 10%, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

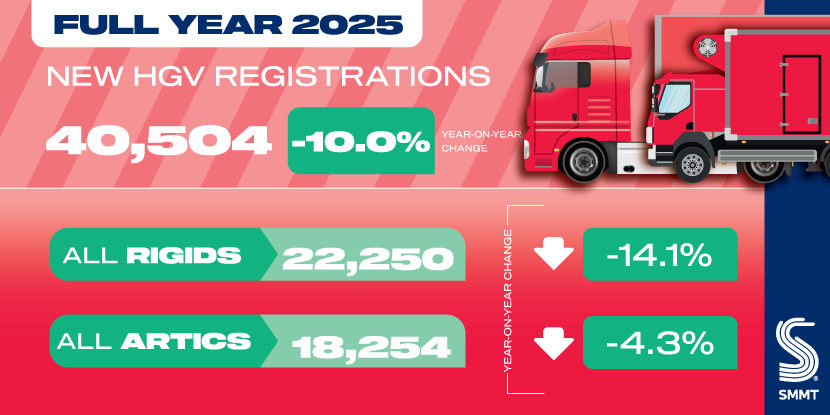

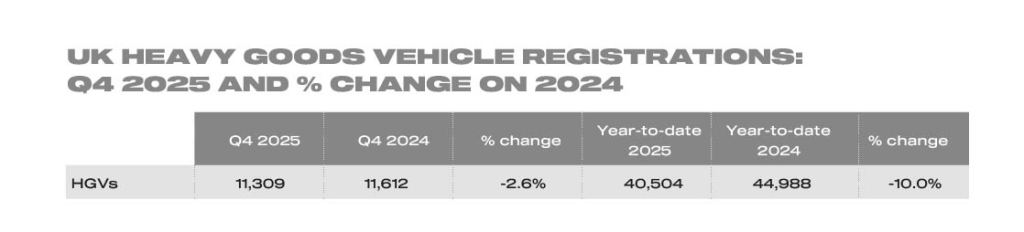

A total of 40,504 new heavy goods vehicles were registered last year, marking a return to more typical levels after three years of post-pandemic fleet renewal. The market declined in every quarter, reflecting economic pressures and a more cautious investment climate across the haulage sector.

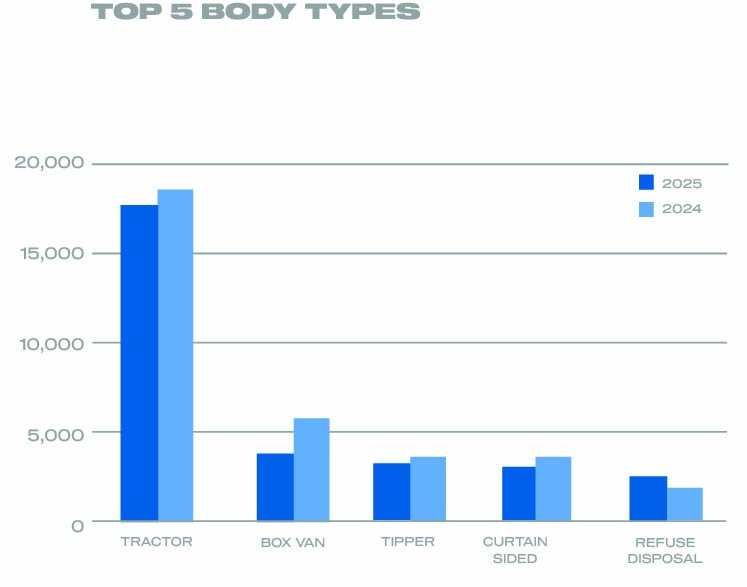

Tractor units, which account for nearly 44% of the market, fell 4.4% to 17,758 units. The final quarter offered some relief, with growth of 6.9%, but it was not enough to offset earlier weakness. The box van segment experienced the steepest fall, down 28.1% to 3,949 registrations, while tipper and curtain-sided trucks also recorded double-digit declines. Refuse collection vehicles provided the only significant uplift, rising 22.6% to 2,459 units.

While overall volumes softened, zero emission HGV registrations moved sharply in the opposite direction. Uptake rose 170.5% year-on-year to 587 units, setting a new annual record. Growth accelerated towards the end of the year, with Q4 registrations up 251% compared with the same period in 2024.

The increase means the UK has now surpassed 1,000 zero emission truck registrations. A broader product offering helped drive demand, with 21 different zero emission models registered across multiple use cases in 2025.

However, zero emission HGV registrations still represent just 1.4% of the overall market, or roughly one in every 71 new trucks. For most operators, adoption remains at an early stage.

Infrastructure continues to be the defining constraint. Some fleets report depot-to-grid connection delays of up to 15 years, creating uncertainty around long-term investment planning. Although the improved Plug-in Truck Grant and the new Depot Charging Scheme are designed to support transition, operators require confidence that grid capacity and planning approvals will align with vehicle delivery.

SMMT Chief Executive Mike Hawes said:

“The new HGV market continues to normalise amid economic constraints on fleet investment, but a return to growth in 2026 is needed so that UK businesses can keep moving with the latest, cleanest vehicle technology. Innovative new models are helping to lift zero emission truck uptake but to unlock real growth, we need faster depot grid connections and planning approvals – only then can more operators invest and capitalise on the benefits of zero emission fleets.”

The direction of travel is clear. The pace of infrastructure delivery will determine how quickly zero emission HGV registrations move from early adoption to mainstream fleet reality.

More Information:

Society of Motor Manufacturers and Traders (SMMT): https://www.smmt.co.uk

For more like this visit the Trucking Magazine website (https://truckingmag.co.uk), or subscribe to Trucking Magazine here (https://shop.kelsey.co.uk/trucking-magazine).